China’s digital economy has grown into a vital pillar of the nation’s growth. It encompasses e-commerce, fintech, telecommunications and more, making up nearly 42.8% of China’s GDP in 2023, up from 27% in 2015. Beijing has championed initiatives like “Internet Plus” and “Digital China” to harness digital technologies as a new engine for development.

China’s leadership has prioritized digital transformation through strategic policies. The 14th Five-Year Plan (2021–2025) set a goal for core digital economy industries to reach 10% of GDP by 2025 – a target achieved two years ahead of schedule in 2023. This national plan calls for massive investment in information infrastructure (such as 5G networks and data centers) and promotes treating data as a production factor, while deepening the integration of digital technology with the real economy. It also emphasizes building smart cities and digital villages with advanced services, and improving cybersecurity and data governance alongside international digital cooperation.

For example, China has rapidly expanded its computing infrastructure – its national computing power reached about 230 EFLOPS in 2023, ranking second in the world. The country generated 32.85 zettabytes of data last year (2022), a 22% year-on-year surge, fueled by ubiquitous smartphones, 5G connectivity and a boom in online content creation. Digital technologies have increasingly been integrated across economic and social sectors in China, promoting the accelerated formation of new productive forces and efficiency gains.

At high-profile events like the Global Digital Trade Expo, China showcases its digital prowess with exhibits ranging from AI-powered robots to smart traffic systems. The 2024 expo in Hangzhou, for instance, attracted over 1,500 companies and unveiled hundreds of new tech products, highlighting the latest innovations in the digital economy sector. China’s digital industries reported a combined revenue of ¥32.5 trillion in 2023, reflecting robust growth in areas such as e-commerce, cloud computing and online services. Such exhibitions underscore China’s ambition to be a world leader in the digital economy.

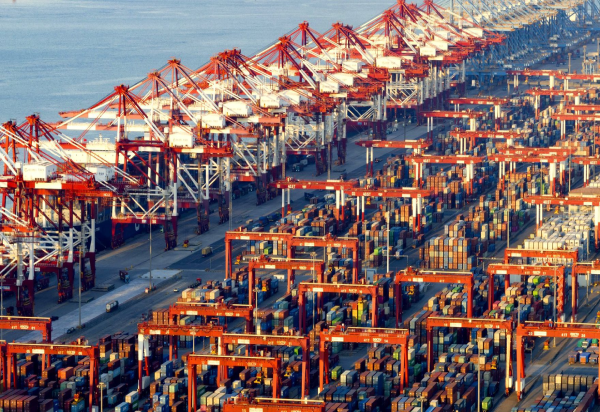

China’s digital economy is driven by innovative companies and new business models. Tech giants like Alibaba, Tencent, Baidu, JD.com and others have built vast platforms for online commerce, payments, social media and cloud services. Nearly one billion Chinese consumers now use cashless mobile payment apps, and e-commerce sales continue to surge – including new trends like live-streaming commerce that connects merchants and shoppers in real time. At a recent trade fair, Chinese sales staff even promoted African products via livestream to online shoppers in China, exemplifying how digital platforms are boosting cross-border trade. Chinese firms such as Shein and the domestic TikTok counterpart Douyin have also gained global prominence, underlining the country’s digital influence beyond its borders.

To sustain this growth, massive investments are being poured into digital infrastructure and innovation. The government launched a “New Infrastructure” initiative, allocating around ¥10 trillion (about $1.4 trillion) through 2025 to build ultra-fast networks, data centers, industrial internet platforms and smart city tech. Private sector investment has flourished as well – China is home to dozens of tech “unicorn” startups, and its venture capital scene has heavily funded companies in fintech, artificial intelligence, and e-commerce. Meanwhile, the People’s Bank of China is piloting a central bank digital currency (the e-CNY) across numerous cities, signaling official support for fintech innovation. All these efforts aim to solidify the foundations of a digital-first economy.

Despite remarkable progress, China’s digital economy faces multiple challenges. Authorities have tightened regulation on the sprawling tech sector in recent years – addressing monopolistic practices and data security risks – through measures such as anti-monopoly fines on big firms (e.g. Alibaba paid a record $2.8 billion penalty) and new privacy laws. This “tech crackdown” from 2020–2022 led to slower investment and even temporary setbacks for companies like ride-hailing giant Didi (whose app was pulled from stores over a cybersecurity review). By 2023, however, policymakers signaled a more supportive stance, recognizing digital platforms as essential drivers of growth. Another challenge is technological self-reliance: U.S. export controls on advanced semiconductors have prompted China to accelerate domestic chip development, a vital effort to sustain future digital innovation. Furthermore, the government must balance rapid digitalization with closing the digital divide (so that smaller cities and older citizens are not left behind) and safeguarding cyberspace against threats.

Looking ahead, China sees enormous opportunity in the digital economy to transform its society and global standing. As automation and AI become ubiquitous, the digital economy can help offset labor shortages from an aging population by boosting productivity in factories and services. The integration of advanced tech like AI, cloud computing and big data with traditional sectors (from agriculture to manufacturing) promises new growth avenues and efficiency gains. Internationally, China’s Digital Silk Road initiative is exporting its digital infrastructure and standards abroad – from 5G networks in Asia to e-commerce platforms in Africa – expanding its influence. By 2035, China aims to fully modernize its economy with digital technology at the core, and by 2030 it aspires to be a global innovation hub in fields like artificial intelligence. If challenges are managed, China’s digital economy is poised to continue its rapid expansion, offering vast opportunities for entrepreneurship and improving quality of life for its people.