With its growing economic clout, China has become a pivotal player on the global stage. Since 2016, China has been the world’s largest economy in terms of purchasing power parity (PPP), accounting for 19% of the global economy by PPP and 18% in nominal terms in 2022. It also ranks second globally in nominal GDP. Historically, China’s robust economic growth was driven by investment and export-oriented manufacturing—a model that earned it the title of “the world’s factory.” However, recent developments indicate that this approach has reached its limits, leading to economic, social, and environmental imbalances. In response, the Chinese government is now focusing on reducing overreliance on investment and boosting domestic demand as the foundation for growth. This shift is not merely an economic choice but a necessary adjustment to ensure sustainable growth amid rising global trade protectionism and supply chain challenges.

China’s GDP growth is estimated to slow to 4.9% in 2024, down from 5.1% in 2023, reflecting broad-based weakness in domestic demand. Nevertheless, a modest recovery to 4.5% is projected for 2025, supported by recent policy stimulus measures and strong export momentum in late 2024. Notably, there is divergence in GDP growth estimates for 2024, with some sources citing 4.9% (World Bank) and 5.0% (PwC), while others (RHG) suggest figures between 2.4% and 2.8%. This disparity—especially in key sectors such as investment and consumption—raises serious questions about the transparency of Chinese economic data, potentially undermining investor confidence and policy-making, and adding an element of uncertainty to China’s economic outlook.

Economic Growth Drivers and Current Trends

An analysis of China’s GDP components reveals a significant structural shift. In 2024, the services sector accounted for the largest share at 56.8% of GDP, followed by industry at 36.5% and agriculture at 6.8%. The dominance of services marks an important transition away from heavy industry and manufacturing dependence and aligns with the “dual circulation” strategy, which aims to boost domestic consumption and services. While promising, this transition also requires labor market adjustments and new skill development to accommodate a shifting workforce.

From an expenditure perspective, household consumption and fixed capital investment contributed almost equally in 2024, each representing 39.9% of GDP. This indicates that China still relies heavily on investment, despite government efforts to promote consumption. The challenge is not just to increase consumer spending but to shift consumer behavior from high savings to greater spending, which requires robust policies to rebuild long-term confidence.

Fixed capital investment growth slowed to 3.2% by December 2024 due to a weak real estate sector. However, manufacturing investment rose by 9.2%, led by high-tech sectors growing at 8.0%, signaling a clear structural shift towards advanced, value-added industries.

The following table shows the expected slowdown in China’s economic growth in the short- to medium-term, reflecting structural challenges:

| Year | Projected GDP Growth |

|---|---|

| 2024 | 4.9% (estimate) |

| 2025 | 4.5% (forecast) |

| 2026 | 4.0% (forecast) |

This ongoing slowdown is not just numerical—it signals that China is entering a more mature and sustainable phase of growth, where rapid investment- and export-driven expansion is no longer the norm. This necessitates a comprehensive policy shift to focus on new, sustainable growth drivers such as innovation and domestic consumption.

The next table illustrates the structural shift in China’s economy toward the services sector:

| Sector | Share of GDP (2024) |

|---|---|

| Services | 56.8% |

| Industry | 36.5% |

| Agriculture | 6.8% |

This high service sector share aligns with China’s ambition to become a consumption- and innovation-driven economy rather than merely a manufacturing hub. The shift will significantly impact labor markets, job types, and income distribution across the country.

Major Economic Challenges

China’s economy faces several complex structural challenges requiring comprehensive solutions:

Real Estate Crisis

The real estate crisis is a key structural issue, as the sector once represented up to 20% of China’s economic activity. Giants like Evergrande and Country Garden are grappling with massive financial difficulties, with Country Garden losing $27.5 billion in 2023 and Evergrande nearly $94 billion in 2021. The crisis was exacerbated by stringent government regulations on developer debt introduced in 2020. It is estimated that there were 60 to 80 million vacant apartments in China by August 2023, indicating a saturated market.

This crisis is not merely a developer debt issue—it is a major factor undermining consumer confidence and dampening domestic demand. A large portion of household wealth is tied to real estate, so falling prices or uncompleted projects directly impact consumers’ ability and willingness to spend. Moreover, local governments heavily depend on land sales revenue, making the crisis a direct threat to their financial stability and ability to fund public services.

Local Government Debt

Local governments face massive “hidden” debt, with local government financing vehicles (LGFVs) holding 58 trillion yuan in liabilities, posing “a serious risk to financial stability.” Declining land sale revenues, once a primary debt funding source, are exacerbating the problem. There is a worrying causal loop between the real estate crisis and local government debt: a weak property market reduces land sales income, limiting governments’ debt repayment ability and their capacity to fund infrastructure and services, which depresses overall demand and recovery. Governments may impose property price controls to avoid a broader collapse, further hindering recovery.

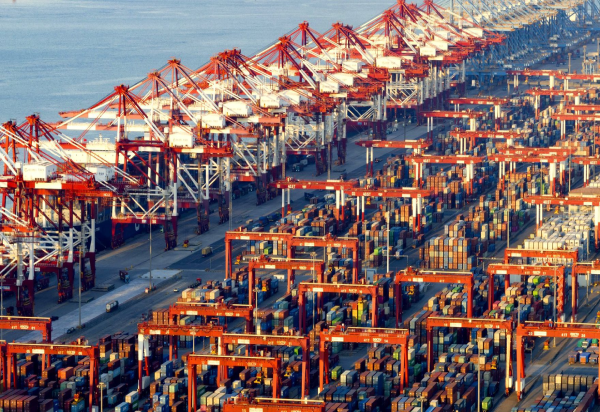

Excess Production Capacity

Overcapacity remains a major concern, especially in traditional sectors like steel and coal, but also in high-tech and clean energy sectors such as EVs, lithium batteries, and solar panels. China’s industrial capacity utilization often falls below 80%, reaching 74.9% in August 2024, indicating inefficiency. This leads to dumping of low-priced goods in global markets, triggering trade disputes and protectionist measures from the U.S. and EU.

While China seeks to lead “green growth” and heavily supports green industries, overcapacity in these same sectors (EVs, batteries, solar panels) is creating major international trade tensions. Ironically, China’s efforts to achieve its environmental and economic goals may backfire in global trade, increasing protectionism instead of fostering clean energy cooperation.

Demographic Challenges

China faces a dual demographic crisis of declining birth rates and rapid aging. In 2024, China’s population declined for a third straight year, with a fertility rate of 1.01 births per woman—well below the replacement rate of 2.1. This leads to a shrinking workforce and rising healthcare and social costs, straining the budget. A smaller, older population constrains long-term economic growth by reducing the labor force and increasing dependency ratios. It also impacts consumption (fewer young consumers), innovation (fewer young talents), and overall productivity. Automation may help, but it cannot fully offset the long-term reduction in consumer and producer bases.

Trade Tensions and Sanctions

The U.S.-China trade war caused sharp declines in bilateral trade in key sectors. In response, China diversified its trade partners, increasing trade with ASEAN, South America, the EU, and Africa. The U.S. is pressuring China to halt oil imports from Iran and Russia, threatening severe tariffs. China’s trade diversification is not just defensive but a proactive strategy to enhance economic resilience and reduce reliance on any single market or partner. This could reduce future geopolitical risks but may also lead to the formation of new global trade blocs, reshaping international trade dynamics.

Government Strategies for Economic Transformation

China’s government is implementing ambitious strategies to address challenges and achieve sustainable growth:

Dual Circulation Strategy

This strategy seeks to balance internal and external development, with domestic markets as the core. The goal is to increase local consumption and investment, reducing export dependence and fostering balanced, sustainable growth. Measures include tax cuts and increased social spending to stimulate demand. The strategy is a fundamental redefinition of China’s growth model, emphasizing internal demand to mitigate vulnerabilities from overreliance on exports and FDI in an increasingly volatile global environment.

Infrastructure Investment

China boasts the world’s largest high-speed rail and road networks and builds about 10 airports annually. Its high-speed rail network spans over 48,000 km, linking nearly all major cities, improving travel speed, comfort, and efficiency. Infrastructure investment is not just about efficiency; it is a powerful tool for social cohesion and integrating culturally diverse regions, promoting regional economic growth and narrowing disparities.

Policies to Rebuild Consumer Confidence and Stabilize Employment

The government is striving to restore consumer confidence weakened by COVID-19 policies, a weak job market, and the real estate downturn. Youth unemployment (ages 16–24) was 15.8% in April 2025, significantly above overall unemployment. In April 2025, China’s central bank cut interest rates to boost spending and investment. Consumer confidence is not only impacted by real estate but also by high youth unemployment, creating a vicious cycle of reduced income, spending, and economic growth. Interest rate cuts aim to spur spending, but their effectiveness depends on restoring confidence and job market stability.

Future Opportunities and Promising Sectors

Despite challenges, China has significant growth potential in certain sectors:

Tourism as a Vital Sector

China is the world’s largest tourism market. Pre-pandemic, tourism contributed 10% of GDP. Cultural tourism revenue reached $1.97 trillion in the past year, while total tourism revenue was $65.28 billion in 2024. International visitors to China numbered 32 million in 2024, down 51% from 2019’s 65.7 million. The government launched around 37,000 cultural tourism events nationwide during summer.

Tourism, especially cultural and eco-tourism, is key to economic recovery and soft power. Efforts to boost inbound tourism and relax visa rules aim not only at revenue but also at cultural exchange and diplomacy.

| Year | International Tourism Revenue (USD Billion) |

|---|---|

| 2023 | 24.80 |

| 2024 | 39.70 |

The 60% increase from 2023 to 2024 highlights tourism’s role in recovery. Though visitor numbers remain below pre-pandemic levels, rising revenue suggests higher per-visitor spending or a shift toward higher-value tourism.

Cultural and Eco-Tourism

China has the most natural heritage sites globally, generating over 14 billion yuan annually in local tourism revenue. Top attractions include the Great Wall (10 million+ visitors/year), Forbidden City (19.3 million in 2019), Terracotta Army, Summer Palace, and Temple of Heaven. Rich cultural experiences include tea ceremonies, Chinese calligraphy, Peking Opera, and regional cuisines. Eco-tourism is booming, with growing winter tourism revenue reflecting interest in sustainability.

Conclusion: Outlook for China’s Economy Amid Global Shifts

China’s economy faces complex structural challenges—from real estate and local government debt to demographics and overcapacity. Yet, its ambitious strategies like dual circulation and tech innovation investment offer growth potential.

China’s future growth will depend on rebalancing investment and consumption, fostering domestic innovation, and managing demographic and geopolitical challenges effectively. Bold structural reforms are needed—without them, China risks prolonged slowdown and deepening economic strain.