This article offers a comprehensive analysis of China’s rise as a global technological power, focusing on its innovation strategies, key technology sectors, and the roles of government and private enterprise. It also explores the impact of technology on Chinese society, the growing technological competition with the United States, and challenges related to intellectual property and data governance. The report concludes with a forward-looking perspective on the strategic implications of China’s technological ascent for the global landscape.

Introduction: The Strategic Imperative of Technological Leadership

China, under the leadership of Communist Party General Secretary Xi Jinping, recognizes the critical advantages of achieving “innovation leadership” in global technological competition. It has intensively designed, implemented, and funded programs to dominate the technologies of the future. These efforts are aimed at supporting the “national rejuvenation” strategy—making China strong, self-reliant, and resilient against what it perceives as technological “containment” by the United States and its allies.

China’s drive for technological self-sufficiency and global leadership, particularly in critical and emerging technologies, is a direct response to perceived external containment efforts and forms a core pillar of its long-term national rejuvenation agenda. This is not merely an economic ambition, but a strategic necessity aimed at reinforcing national security and geopolitical influence. Beijing’s emphasis on “chokepoint technologies” reflects a keen awareness of the need to reduce dependence on foreign tech—especially amid an increasingly adversarial international environment. This explains China’s massive R&D investments and state-centered industrial policies aimed at technological dominance.

Key Areas of Technological Advancement

China has focused on developing several key emerging technologies, including artificial intelligence (AI), quantum technologies, biotechnology, and battery energy storage systems. It has made significant advances in these sectors.

In AI, China is progressing rapidly and investing heavily, not only for economic growth but also for military applications. Chinese generative AI models, such as DeepSeek and Alibaba’s Qwen3, have demonstrated performance on par with—and in some cases surpassing—their Western counterparts. Companies like Z.ai have also released cost-effective open-source models.

In quantum technologies, China is heavily funding research into quantum computing, sensing, and communications. In biotechnology, China aims to reduce reliance on U.S. agriculture and integrate Chinese firms into American food supply chains in areas like genomics and pharmaceuticals. Companies such as WuXi Biologics and WuXi AppTec are global leaders in pharmaceutical R&D and manufacturing services.

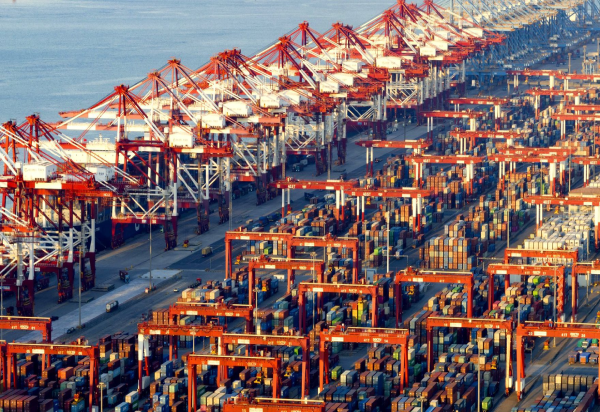

In renewable energy, China was the main driver of global increases in clean energy installations in 2023, accounting for 63% of global growth. China dominates solar and wind technology production and nearly monopolizes entire supply chains, including the mining and processing of rare earth minerals. This massive manufacturing capacity has driven down global prices, reducing the cost barrier to renewable energy systems for developing nations.

China’s leadership in high-impact research across a wide range of critical technologies—hosting many of the world’s top research institutions—underscores the effectiveness of its long-term, policy-driven strategy and state-focused investment model. Leading in 37 out of 44 tracked technologies, according to ASPI, with some technologies featuring all top 10 global research institutions based in China, is evidence not of organic growth alone but of deliberate strategic planning. This suggests that China uses a comprehensive, integrated approach to direct resources toward strategic tech areas, enabling breakthroughs in innovation.

The rapid commercialization of AI models and development of domestic chip alternatives by tech giants like Huawei, Alibaba, and Tencent—despite U.S. export restrictions—demonstrates remarkable resilience and accelerated innovation within China’s tech ecosystem. Huawei’s CloudMatrix 384 AI cluster, for instance, featuring 384 of its latest 910C chips, outperformed similar Nvidia clusters in certain metrics. This indicates China is not merely importing technology but is investing heavily in in-house chip design and manufacturing, reducing its exposure to external pressures.

Government Support and the Innovation Ecosystem

China employs a “whole-of-nation” approach to innovation, characterized by broad government funding, strategic guidance funds, and active involvement of state-owned enterprises (SOEs). In 2023, China allocated 2.64% of its GDP to R&D. SOEs play a critical role in directing resources to sectors prioritized by the state, such as AI, nuclear energy, and space.

This “whole-of-nation” strategy forms a powerful and centralized mechanism for channeling resources into strategic technological breakthroughs. SOEs, as “pillars” in China’s self-reliance and high-tech innovation drive, ensure innovation efforts align with national priorities and enable large-scale resource allocation. This contrasts with Western models that rely more heavily on private-sector-driven innovation, giving China an edge in coordinating and directing national efforts toward defined objectives.

The shift toward enterprise-led research, supported by tax incentives and the creation of innovation consortia, reflects a strategic evolution in China’s innovation model aimed at more effectively bridging scientific discovery and industrial application. Enterprises now contribute over 75% of national R&D spending and employment. Leading firms are encouraged to form innovation consortia with universities, SMEs, and research institutes. This reflects recognition that innovation thrives through collaboration and that turning patents into marketable products requires academia-industry integration.

Technology’s Impact on Society and Daily Life

China’s market-driven digital transformation—especially in e-commerce and mobile payments—has deeply reshaped daily life and consumer behavior, creating a unique digital ecosystem that serves as a massive testbed for new technologies and business models. China accounts for over 40% of global e-commerce transactions. Mobile payments via platforms like Alipay and WeChat Pay have fueled the boom in online shopping and personal banking.

This market-driven digital shift has not only improved efficiency and created jobs in new sectors but also raises significant concerns about data security and personal privacy—especially with the expansion of smart city initiatives. China’s smart city market grew twentyfold in 2022 compared to 2016, yet faces challenges in balanced development, unclear top-level design, and slow digital tech adoption.

Widespread adoption of digital technologies, while boosting efficiency and job creation, also triggers major concerns over data security and personal privacy, particularly with the proliferation of surveillance and data-collection systems in smart cities. While extensive surveillance helps deter crime, it raises questions about individual freedoms. This reflects a tension between the practical benefits of technology in urban management and social control, and liberal values around privacy and transparency. The challenge lies in balancing technological innovation with the protection of individual rights in a rapidly digitizing society.

Global Competition, IP, and Data Governance

Tech competition between the U.S. and China is leading to a significant split in the global technology sector across content, market, and regulatory dimensions, with profound implications for global innovation, trade, and tech interoperability. China’s “Great Firewall” limits Western content access. It also seeks self-sufficiency in technologies from semiconductors to AI, creating market divergence from Western tech systems.

This tech competition reflects a broader strategic struggle to shape the future of the internet and global technology standards, potentially leading to bifurcated ecosystems. China’s strict data governance laws and its push for its own tech standards—alongside IP protection concerns—signal a strategic effort to assert digital sovereignty and reduce reliance on Western frameworks, possibly fragmenting global digital norms.

China’s increasingly strict data governance laws and its push for proprietary standards, alongside IP protection concerns, highlight its ambition to assert digital sovereignty and reduce dependence on foreign technology, potentially causing a fragmentation of global digital standards. Through controlling data flows and setting standards, China seeks to shape a global digital environment aligned with its values and strategic goals. This pressures democratic systems to develop their own standards ensuring transparency and privacy, deepening global divergence in digital governance.

Future Outlook and Strategic Implications

China’s continued investment in “new quality productive forces” and its pursuit of tech self-reliance signal intensifying global tech competition, as China leverages its massive domestic market and industrial capacity to dominate future industries. Investment in high-tech sectors rose 8.0% in 2024.

This focus on high-value manufacturing, such as new energy vehicles and service robots, indicates a clear strategy to move up the value chain. China no longer aims to be merely the “world’s factory” but rather the “world’s innovator,” likely transforming global supply chains and shifting tech power balances.

The success of China’s “catch up and replace” model—where foreign tech firms are edged out once local alternatives reach “good enough” standards—shows a deliberate industrial policy to shift market share to domestic players and secure global competitiveness. This has worked in high-speed rail, 5G equipment, and EVs. Western firms integrating China’s innovation system into global R&D risk losing technology and market share long term.

Conclusion

China has emerged as a formidable global tech power, driven by a clear national strategy, massive R&D investment, and a tightly integrated innovation ecosystem linking academia and industry. These efforts have led to Chinese leadership in critical technologies, from AI to renewables.

Yet, this technological rise is fraught with challenges and complex consequences. Growing U.S.-China competition is splitting global tech, raising concerns over IP and data governance. While China’s state-driven model effectively channels resources, it also raises questions about transparency and privacy. How China manages these challenges—and how global powers respond to its tech ambitions—will shape the technological and economic landscape for decades to come.