Charting China’s Course in a Dynamic Global Landscape

Forecasting China’s economic and technological trajectory through 2035 and beyond requires a nuanced understanding of its ambitious national strategies, persistent structural challenges, and the evolving global geopolitical environment. As China navigates its “new normal” of slower yet higher-quality growth, its ability to rebalance the economy, achieve technological self-sufficiency, and manage internal and external risks will shape its future. This article explores China’s prospects for consumption-driven growth and industrial upgrading, its relentless pursuit of leadership in artificial intelligence and semiconductors, and the long-term implications of policy frameworks such as Dual Circulation and Common Prosperity. It will also analyze China’s evolving role in the global order, taking into account potential risks and uncertainties that could impact its trajectory toward its centenary goals.

Economic Outlook: Sustaining “Quality Growth” and Overcoming Obstacles

China is at a pivotal point of economic transformation, aiming for sustainable, high-quality growth through structural rebalancing and addressing both domestic and external challenges.

Path Toward Consumption-Driven Growth: Prospects and Challenges

The Chinese government is shifting its focus “decisively” from investment-led to consumption-driven growth. This is a bold pivot, considering that consumption accounted for only 35–40% of China’s GDP in 2024—far below the 65–70% typical in the United States. The transition is expected to take decades.

Challenges include entrenched saving habits, a struggling real estate sector (negative equity, job security fears), and a lack of consumer confidence. Policy priorities include boosting household incomes, encouraging consumption in key areas (automobiles, electronics), and stabilizing housing-related spending.

This shift represents a deep structural transformation that faces significant behavioral and systemic inertia. Decades of prioritizing savings and investment have created entrenched habits and reliance on real estate wealth, making reversal difficult and framing the transition as a generational challenge rather than a quick policy fix. The property crisis directly affects consumer confidence and wealth, reducing willingness to spend. Moving away from an investment-heavy model undermines traditional wealth accumulation mechanisms, creating uncertainty. The success of rebalancing hinges on the government’s ability to restore confidence and build a strong social safety net—an effort that could take decades. Failure could result in prolonged domestic demand stagnation.

Deepening Industrial Modernization and Advanced Manufacturing

China is deepening supply-side structural reforms and accelerating the development of “new quality productive forces.” This includes increased investment in manufacturing and infrastructure, transformation of traditional industries, and leveraging innovation to strengthen industrial chains.

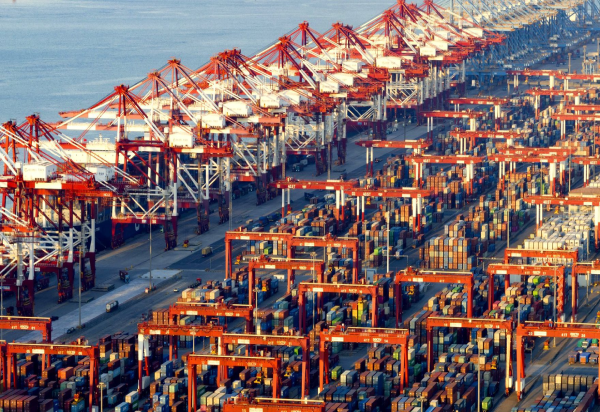

The “Made in China 2025” strategy emphasizes “quality over quantity” and cultivating technological talent, aiming to shift from being the “world’s factory” for cheap goods. Advanced manufacturing stands out as a “clear bright spot” in economic data, with significant growth in electric vehicles, solar cells, and integrated circuits.

Industrial modernization is a deliberate, state-driven pivot towards advanced manufacturing and innovation, driven by the need to climb the value chain and reduce reliance on low-cost production. This strategic shift is vital for sustaining growth in a maturing economy and boosting global competitiveness. It represents a proactive move to avoid the “middle-income trap” by transitioning from factor-driven to innovation-driven growth. The goal is to secure China’s position in future global industries, not just in scale but in technological sophistication. This will intensify global competition in high-tech sectors, potentially triggering further trade tensions and industrial policy responses from major economies seeking to protect their industries.

Addressing Structural Imbalances: Long-Term Strategies for Debt, Real Estate, and Demographics

Debt and Real Estate: The real estate sector and local government debt remain key challenges. Strategies include stabilizing housing-related spending, better mobilizing private capital for investment, strengthening oversight of local government debt and shadow banking, and balancing risk prevention with reform.

Demographics: China faces declining birth rates and an aging population. While policies addressing this are not explicitly detailed in official summaries, the challenge is acknowledged.

China’s long-term stability depends on its ability to manage interconnected structural imbalances. The approach to debt and real estate is not a quick fix but a gradual, balanced effort to reduce financial risks without triggering a sharp downturn. Demographic challenges, though deeply structural, require sustainable social and economic adaptations. The government acknowledges the systemic nature of these issues and opts for a controlled, gradual approach over massive stimulus. This reflects a long-term commitment to structural reform, recognizing that these issues cannot be resolved swiftly. The success or failure of these strategies will shape China’s economic stability and growth potential for decades. Failure could lead to prolonged stagnation or social unrest, affecting China’s global standing.

Technological Frontiers: Driving Innovation and Achieving Self-Sufficiency

China is at the forefront of technological innovation, striving for self-reliance in strategic sectors like artificial intelligence and semiconductors.

AI Leadership Race: Next-Generation Models and Applications

China aims to be a global AI leader by 2030. Its AI policy has evolved through phases and is now at a “crossroads era,” where technological confidence meets economic fragility.

Chinese AI models are narrowing the performance gap with top U.S. models (e.g., DeepSeek-R1), indicating continued commitment to AI development despite economic challenges.

Semiconductor Dominance: Domestic Production and Global Ambitions

China aims to become the world’s largest semiconductor manufacturing hub by 2030, targeting 30% of global capacity, surpassing Taiwan. China’s chip production grew by 15% in 2024 and is projected to reach 10.1 million wafers per month by 2025.

This growth is driven by massive investments in domestic manufacturing, aligned with Beijing’s goal of achieving self-sufficiency in chip production. It underscores China’s strategic push to reduce reliance on foreign suppliers, especially amid U.S. export restrictions.

Innovation Ecosystem: Talent, Data, and Infrastructure

China benefits from a vast talent pool, producing over 2 million STEM graduates annually. Cities like Beijing and Shanghai are talent hubs, offering household registration support, housing subsidies, and R&D grants.

China accounts for a significant share of highly cited AI papers and a quarter of the world’s top AI scientists, reflecting strong human capital to support its tech ambitions.

Geopolitical Landscape: Navigating a Contested Global Order

China’s international relations are complex, marked by strategic rivalry with major powers, expansion of influence through initiatives like the Belt and Road, and active participation in shaping global norms.

U.S.-China Rivalry: Trade, Tech, and Strategic Competition

The U.S.-China trade war saw U.S. tariffs on $250 billion of Chinese imports, with China retaliating on $110 billion of U.S. goods, sharply reducing bilateral trade.

The U.S. aims to reduce dependence on Chinese goods and boost domestic manufacturing. China is offsetting this decline by expanding exports to Southeast Asia, Latin America, and Europe, highlighting its adaptation through trade diversification.

Belt and Road Initiative (BRI): Expanding Influence Amid Criticism

The BRI promotes regional economic integration via infrastructure, trade, and investment across Asia, Africa, and Europe, significantly expanding China’s influence.

However, concerns over debt sustainability in countries like Sri Lanka and Pakistan highlight geopolitical risks. While economically beneficial, the BRI faces challenges related to debt sustainability and strategic pushback.

Multilateral Engagement: Shaping Global Norms and Institutions

Since 2017, China has been the world’s largest official bilateral creditor, granting it leverage in sovereign debt restructuring negotiations.

China is promoting an alternative financial system based on broader RMB usage and RMB-based financial infrastructure, aiming to reduce global dependence on the U.S. dollar and Western systems—reflecting ambitions to reshape global financial governance.

Domestic Dynamics and Societal Resilience

China’s internal dynamics are crucial to its future path as it seeks to balance economic growth, social equity, and environmental sustainability.

Common Prosperity: Balancing Equity and Efficiency

“Common Prosperity” is a declared goal to enhance social equality and economic justice, aiming to address entrenched inequalities and ensure equal opportunities.

However, its implementation has included sweeping regulatory crackdowns on private industries, raising concerns about impacts on economic efficiency. This highlights tension between social equity goals and market dynamism.

Demographic Dividend Reversal: Implications for Labor and Consumption

China’s declining birth rate and aging population, a legacy of the one-child policy, are shrinking the labor force and increasing dependency ratios, affecting long-term growth prospects.

Environmental Oversight: Green Transition and Energy Security

China is the world’s largest investor in renewables and leads in solar and wind capacity. However, it still relies heavily on coal (70% of electricity from fossil fuels in 2022).

This reflects a dilemma between environmental goals and energy security, as China meets rising energy demand while transitioning to cleaner sources.

Conclusion: Navigating Complexity on the Path Forward

China is advancing toward a future defined by quality growth, technological self-reliance, and rising geopolitical influence. However, this path is fraught with challenges, including the need to rebalance toward domestic consumption, address real estate and debt imbalances, and adapt to major demographic shifts.

Success by 2035 and beyond will depend on China’s ability to balance state control with market dynamism, promote innovation while ensuring social justice, and achieve environmental goals while safeguarding energy security. The complex interplay of these factors will shape China’s place in the evolving global order.

Table 1: China’s Real GDP Growth Rates (Historical and Projected)

| Time Period | Real GDP Growth Rate |

|---|---|

| 2007 | 14.2% |

| 2018 | 6.6% |

| 2022 | 3.1% |

| 2023 | 5.4% |

| 2024 (Projected) | 5.5% |

| 2025 (Projected) | ~5% |

Table 2: Key Innovation Metrics in China (R&D Spending, Patents, STEM Graduates)

| Metric | Year | Value | Notes |

|---|---|---|---|

| R&D Spending | 2023 | $1.8 trillion USD (PPP-adjusted) | Growing at nearly twice the rate of U.S. R&D spending. |

| R&D Spending as % of GDP | 2023 | 2.64% | Lower than U.S. (3.39%). |

| Annual STEM Graduates | Unspecified | Over 2 million | Provides a large talent pool for R&D teams. |

| Share of Top AI Scientists from Chinese Universities | Unspecified | One-quarter of global total | Indicates strength in AI talent development. |

| China’s Share of Highly Cited AI Research Publications | Unspecified | Significant | Reflects China’s contribution to global AI research. |

| AI Venture Capital Investment in Chinese Startups | 2017 | 48% of global total | Surpassed U.S. share that year. |

| AI VC Investment in Chinese Startups (YoY change) | Q1 2025 | Dropped by 50% YoY | Reflects cautious investor sentiment. |

| Installed Solar and Wind Power Capacity | March 2025 | 1.4 TW (operational) + 1.3 TW (planned/under construction) | China is the global leader in renewable energy deployment. |

| China’s Share of Global Solar Manufacturing Capacity | Unspecified | Over 80% | Near-monopolistic dominance in clean energy supply chains. |

| China’s Share of Global Battery Production | Unspecified | Over 75% | Critical component of global EV supply chain. |

| China’s Projected Share of Global Semiconductor Manufacturing Capacity | 2030 | 30% | Aims to become the world’s largest chip manufacturer. |