Introduction: Four Decades of Transformation

China’s economic trajectory over the past four decades represents one of the most remarkable transformations in modern history. Before 1979, China’s economy was characterized by poverty, stagnation, centralized control, inefficiency, and relative isolation from the global economy. However, since opening up to trade and foreign investment and implementing free-market reforms in 1979, China has become one of the world’s fastest-growing economies, with an average real GDP growth rate of 9.5% until 2018—described by the World Bank as the “fastest sustained expansion by a major economy.” During this period, China rose to become the world’s largest economy in purchasing power parity (PPP) terms, the largest manufacturer, the top trader in goods, and the largest holder of foreign exchange reserves.

This article examines the core reforms that fueled this growth, analyzes the strengths and structural imbalances of its export-driven model, and explores the strategic reorientation towards domestic consumption and innovation. It also addresses current economic challenges, including real estate sector turmoil, local government debt, demographic shifts, and ongoing issues of income inequality and environmental sustainability.

Origins of Reform: Dismantling Communes and Opening Markets

Since 1979, China has undergone a series of radical economic reforms, transitioning from a centrally planned economy to a global market power. These reforms began in agriculture and expanded to industry and services, fostering private sector growth while maintaining a strategic role for state-owned enterprises (SOEs).

Agricultural Reforms and the Household Responsibility System (HRS)

Reforms started in rural areas with the urgent need to increase food production. Before 1979, agricultural output was inefficiently managed through communes, with top-down planning and weak individual productivity incentives. Although small private plots and rural trade markets existed, private production was heavily restricted, leading to stagnating agricultural growth.

To address this, the government initiated rural reforms in 1979, enlarging private land plots, encouraging production diversification, and expanding free rural markets. By 1984, the Household Responsibility System became dominant. Under HRS, farm households contracted the use of collectively owned land for a set period, met mandatory quotas and taxes, and could sell surplus in markets. Though government plans still influenced crop choices, households gained greater autonomy.

HRS, coupled with higher agricultural prices, led to significant productivity gains. Agricultural output grew by around 8% annually from 1979-1984, compared to under 2% from 1958-1978. This success demonstrated the potential of market-oriented reforms and provided political and empirical momentum for broader liberalization.

Rise of Township and Village Enterprises (TVEs) and the Private Sector

Alongside agricultural reform, restrictions on non-agricultural rural activities eased, spurring the growth of township and village enterprises (TVEs). These entities, often privately or collectively owned, absorbed surplus rural labor and proved more efficient than SOEs due to market discipline. By 1987, TVEs accounted for nearly a quarter of industrial output and employed about 88 million workers.

Legalization of private firms began in 1988 with the “Provisional Regulations on Private Enterprises.” By May 2025, private sector entities (private firms and sole proprietors) reached 185 million, comprising 96.76% of all businesses. Over 58 million were private firms, which increasingly invested in technological innovation and strategic emerging industries, becoming pivotal to industrial upgrading and stable growth.

In 2024, private firms contributed over half of foreign trade and tax revenues, provided over 80% of urban employment, and generated over 70% of China’s technological innovations. Though SOEs still dominate large-cap markets, the private sector’s expanding role underscores a dynamic interplay rather than a binary state-market divide. The 2025 Private Economy Promotion Law signals state support, but past regulatory crackdowns (e.g., on tech firms in 2020) introduce uncertainty. Rapid private sector growth, particularly in innovation and employment, highlights its vital role in China’s economic future. Yet, policy volatility—as seen with past crackdowns—could affect investor confidence and long-term planning.

State-Owned Enterprises (SOEs): Evolution and Enduring Role

Historically, SOEs served national goals, offering social stability via the “iron rice bowl” system until the late 1990s. These enterprises underpinned China’s economy post-1949.

Post-1978 reforms aimed to reduce SOEs’ dependence on state budgets and bank credit, resulting in closures, mergers, or sales of inefficient SOEs. Their share of industrial output fell from 50% in 1998 to 25% in 2011. Reforms also shifted them from profit remittance to income tax and reduced government interference.

Today, SOEs account for about 25% of GDP and retain monopolies in strategic sectors like telecoms, military, railways, tobacco, oil, and power. They support regional development and major initiatives like “Made in China 2025” and the Belt and Road Initiative. Under Xi Jinping, the Communist Party has asserted leadership over SOEs, influencing key decisions.

Despite market reforms and private sector rise, SOEs remain central to China’s economic-political system. Their dominance in strategic sectors and role in industrial and geopolitical strategies signal a hybrid model where market forces operate under ultimate state control, prioritizing national goals over pure efficiency. Xi’s consolidation of Party control reinforces this model.

Export-Led Growth: Achievements and Structural Imbalances

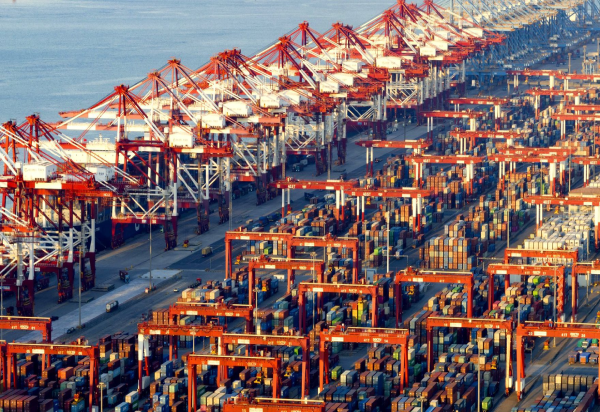

China’s export-led model drove rapid transformation, lifting hundreds of millions from poverty and making China a global manufacturing hub. However, it also created significant structural imbalances, raising sustainability concerns.

Rapid Industrialization and Poverty Reduction

Since 1978, China pursued export-led industrialization, expanding production capacity and lifting millions out of poverty. The model transformed China into the world’s second-largest economy and top exporter. Key strategies included currency management, capital controls, and prioritizing full employment over wage growth. These policies kept production costs low and exports competitive, attracting foreign investment and boosting infrastructure and industrial capacity.

Structural Imbalances: Overcapacity, Inequality, Diminishing Returns

However, heavy investment led to chronic overcapacity in sectors like housing and heavy industry, often resulting in dumping and trade disputes. State-directed capital yielded diminishing returns and asset bubbles. The model entrenched inequality, with household consumption remaining a small GDP share. Its reliance on state-led investment, suppressed wages, and undervalued currency masked internal imbalances and overreliance on external demand, exposing vulnerabilities to global slowdowns and protectionism.

Strategic Rebalancing: Towards Consumption and Innovation

Facing structural and external pressures, China began rebalancing towards more sustainable growth sources, focusing on domestic consumption and innovation.

“New Normal” and Quality Growth Imperatives

As China’s economy matured, GDP growth slowed from 14.2% in 2007 to 6.6% in 2018, and is projected at 5.5% by 2024. The government embraced this slowdown as the “new normal,” shifting towards a model less reliant on fixed investment and exports, and more on private consumption, services, and innovation to avoid the “middle-income trap.”

The focus shifted to “quality growth,” emphasizing structural modernization, efficiency, sustainability, and innovation. This involved greater R&D investment, high-value industries, and global competitiveness. Services and innovation were promoted as new growth engines, reducing reliance on resource-intensive traditional industries.

Dual Circulation Strategy: Domestic Strength, Global Engagement

Launched in 2020, the dual circulation strategy aims to balance the economy by reducing foreign trade dependence while improving its quality. It emphasizes strengthening domestic supply chains and boosting private consumption and services to reduce reliance on fixed asset investment.

Domestically, the strategy faced challenges, with consumption and services’ GDP share declining post-pandemic. However, trade diversification advanced, with rising trade with Belt and Road countries and ASEAN, reducing reliance on the US and Europe. The strategy also seeks self-sufficiency in resources and technology.

Dual circulation is both proactive and defensive, mitigating external vulnerabilities (e.g., US tech restrictions) via internal economic resilience. It marks a shift from “globalization at any cost” to “protected integration,” maintaining global engagement while building autonomy in critical sectors. This may lead to greater global economic fragmentation as China operates within its sphere of influence.

“Common Prosperity”: Tackling Inequality and State Control

“Common prosperity” is a political slogan and policy goal promoting social equity and economic justice. Mao defined it as collective ownership; Deng Xiaoping reinterpreted it as allowing some to get rich first to help others catch up.

Under Xi Jinping, it gained prominence, aiming for fairer income distribution without forced equality. Policies target excessive incomes, regulate private industries (tech, real estate, education), and increase public social spending.

Beyond economics, it’s an ideological recalibration, reinforcing socialist principles and state control. Crackdowns under this banner prioritize social stability and ideological conformity over unfettered market growth, potentially dampening private sector dynamism. It signals a shift from Deng’s “let some get rich first” to a more interventionist stance, possibly limiting innovation and risk-taking in favor of social cohesion and state-guided resource allocation.

Facing Contemporary Economic Challenges

China faces deep structural challenges from decades of rapid growth, requiring complex and sustainable policy responses.

Real Estate Crisis and Local Government Debt

Real estate, contributing ~30% of GDP, now faces severe challenges: housing oversupply (“ghost cities”), high urban housing prices, and soaring debt (household debt rose from $2T to $10T between 2010-2021).

The “three red lines” policy (2020) aimed to curb developer debt but triggered liquidity crises, bankrupting major firms like Evergrande. This affects household spending, corporate investment, and local government revenues (land sales were 37.6% of local revenue in 2020). The real estate crisis is a systemic risk, entwined with local finance and household wealth, threatening broader economic stability and rebalancing efforts.

Demographic Shifts and Labor Market Dynamics

China faces falling birth rates and an aging population due to the one-child policy. Fertility was 1.3 in 2020 (vs. 2.1 replacement rate); 18.7% of the population was over 60.

Rural-urban migration created “floating populations” lacking full urban social services. Youth unemployment was 21.3% in June 2023. Demographic decline and aging constrain long-term growth, reducing labor supply, increasing dependency ratios, and weakening innovation and consumption. The demographic dividend is reversing, posing challenges to growth and social stability.

Income Inequality and Environmental Sustainability

Rapid growth widened income gaps between urban-rural and coastal-inland areas.

Environmental challenges include air/water pollution, soil degradation, and biodiversity loss. China leads renewable energy investment (30% of global additions in 2020) and aims for carbon neutrality by 2060, but still relies heavily on coal (70% of electricity in 2022) and approved more coal plants.

China balances economic growth, social equity, and environmental goals. “Common prosperity” seeks equity but may hinder efficiency. While leading in renewables, coal reliance and rising emissions complicate climate targets. These tensions require constant policy adjustment in its “socialist market economy.”

Conclusion: Sustaining Growth Amid Complex Transitions

China’s rise from a poor, planned economy to a global powerhouse reflects its pragmatic reform approach. Yet its export-led model bred structural imbalances and external pressures, prompting strategic shifts toward consumption, innovation, and self-reliance. The “new normal” of slower, higher-quality growth brings major domestic challenges in real estate, local debt, demographics, and the broader goals of common prosperity and environmental sustainability.

China’s future success hinges on navigating these transitions, balancing state control with market dynamism, addressing social disparities without stifling innovation, and meeting ambitious environmental goals while ensuring energy security. The interplay of these forces will define China’s economic landscape for decades.

Table 1: Key Milestones in China’s Economic Reforms (Timeline)

| Year | Event/Policy | Brief Description | Impact/Significance |

|---|---|---|---|

| 1978 | Adoption of the “Open Door Policy” | Deng Xiaoping initiated policies to attract foreign technology and investment. | Marked the beginning of China’s economic reform process. |

| 1979 | Establishment of Special Economic Zones (SEZs) | SEZs created in Shenzhen, Shantou, Xiamen, and Zhuhai to attract foreign investment. | Turning point for economic liberalization and expansion of foreign trade. |

| 1979 | Household Responsibility System (HRS) | Responsibility for agricultural production shifted from communes to individual households. | Significant increase in agricultural output (8% annually from 1979–1984) and farmer incomes. |

| 1983 | Shift from Profit Remittance to Income Tax (for SOEs) | State-owned enterprises moved from remitting profits to paying income tax. | Encouraged profitability and reduced SOEs’ reliance on government subsidies. |

| 1988 | Adoption of “Provisional Regulations on Private Enterprises” | Provided a legal framework and formal recognition for private businesses. | Marked the beginning of rapid private sector growth in China. |

| 2015 | Launch of “Made in China 2025” | National plan to upgrade Chinese industry in 10 key sectors. | Aimed to reduce dependence on foreign technology and boost domestic innovation. |

| 2020 | Launch of Dual Circulation Strategy | Aimed to balance and make the economy more resilient by focusing on domestic demand. | Reduced dependence on foreign trade, promoted domestic consumption and innovation. |

| 2021 | Promotion of “Common Prosperity” | Goal to enhance social and economic equity, including regulation of excessive incomes. | Triggered major regulatory crackdowns on private industries (tech, real estate). |

| 2024 | Private Sector Contribution | Over 80% of urban employment; over 70% of technological innovation achievements. | Highlights the critical role of the private sector in economic growth and innovation. |

| 2025 | Private Sector Promotion Law | New law aimed at enhancing legal protection for private enterprises. | Seeks to improve development conditions and ensure fair competition for private businesses. |

Table 2: China’s Economic Structure — Contribution of the Public and Private Sectors

| Metric | Time Period | Public Sector Value | Private Sector Value | Notes/Significance |

|---|---|---|---|---|

| Share of GDP | 2020 | ~25% | Not directly specified, but constitutes the majority of the remaining portion | State-owned enterprises (SOEs) remain significant contributors to the overall economy. |

| Share of Total Business Entities | End of May 2025 | 3.24% (difference from 96.76%) | 96.76% | The private sector dominates in number of business entities, indicating strong market dynamism. |

| Share of Urban Employment | 2024 | Less than 20% (difference from 80%) | More than 80% | The private sector is the main driver of urban job creation. |

| Share of Foreign Trade | 2024 | Less than 50% (difference from half) | More than half | The private sector leads China’s foreign trade activities. |

| Share of Tax Revenues | 2024 | Less than 50% (difference from half) | More than half | The private sector is a major contributor to government tax revenues. |

| Share of Technological Innovation Achievements | Not specified | Less than 30% (difference from 70%) | More than 70% | The private sector is the engine of technological innovation in China. |

| Share of Market Capitalization of Top 100 Listed Companies | End of June 2025 | 62.8% | 37.2% (up from 33.1% in mid-2024) | Despite private sector growth, the public sector still dominates large-cap firms. |

| Share of Total Industrial Output | 1998 | Half | Half | Indicates the declining share of the public sector in industrial production over time. |

| Share of Total Industrial Output | 2011 | One-quarter | Three-quarters | Continued decline of public sector’s share in industrial output. |