Advanced Technology Drives Chinese Export Growth

1. Shift Toward High-Tech Exports

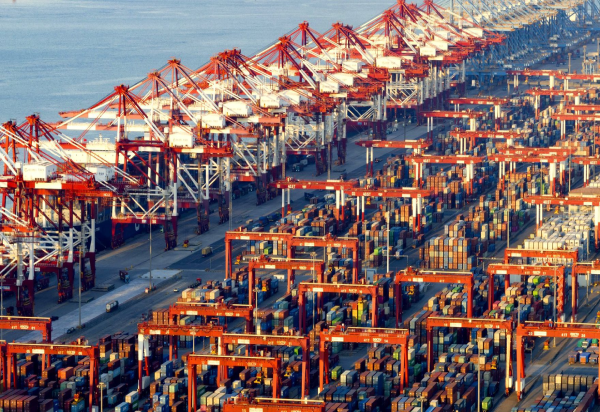

In June 2025, China recorded a 7.2% year-on-year increase in exports, primarily driven by advanced technology products such as semiconductors, electric vehicles, and sophisticated machinery. This shift reflects a structural transition toward high-value manufacturing under China’s “dual circulation” economic strategy and the Belt and Road Initiative.

Semiconductors are at the forefront of this transformation. Companies like YMTC launched advanced 294-layer NAND chips competing with Samsung’s technologies, while CXMT developed DDR5 DRAM, capturing a 5% global market share.

China also exports high-end automotive chips, reaching a total value of $419.15 billion in 2024. This surge is supported by major investments from firms like SMIC, HiSilicon, and BYD Semiconductor, alongside comprehensive government backing.

2. Leadership in Green Energy Technology

Clean technology plays a pivotal role in boosting exports. China produces around 86% of the world’s solar panels and exports millions of EVs and batteries, cementing its role as a global force in the green economy.

The EV sector has seen a remarkable rise, with over 1 million units exported in 2023 and more than 2 million in 2024.

3. Rise of AI and Digital Technologies

Artificial intelligence (AI) is central to China’s future strategy. In 2025, national plans targeted the adoption of smart agents in fields like customer service, cybersecurity, R&D, and regulatory compliance.

In renewable energy, China invested over $230 billion, leveraging modern power grids and green tech solutions to align with global energy demand.

4. Strong Industrial Infrastructure: Semiconductors and Robotics

China relies heavily on domestic investment in semiconductor equipment manufacturing. By Q3 2024, R&D spending rose 50% among A-share listed semiconductor equipment firms. The self-sufficiency rate in equipment is expected to reach 35% by 2025.

The nation also aims to lead in advanced technologies like chiplets, photonic semiconductors, quantum computing, and low-altitude economy platforms (e.g., drones) as foundational pillars for industrial transformation and global competitiveness.

5. Digital Economy and Export Competitiveness

Economic analysis reveals that digital infrastructure and manufacturing help reduce trade costs, foster innovative business models, and support sustainable industrial upgrading—enhancing China’s high-tech export competitiveness.

6. Challenges: Industrial Surplus and Export Pressure

Despite technological success, China faces challenges like overproduction, especially in EVs and solar sectors. This leads to international trade tensions, declining profits, and rising domestic debt.

Conclusion

China has evolved from a low-cost goods exporter to a global tech powerhouse. Its exports are now driven by AI, semiconductors, green energy, and digital technologies. These emerging sectors are the true engine of export growth, despite the need for structural reforms to address surplus and competitiveness issues.

Current Landscape of China’s Tech Economy

1. Digital Performance and Infrastructure Expansion

In 2024, China’s digital industry revenue reached 35 trillion yuan (~$4.8 trillion), up 5.5% year-on-year, with profits at 2.7 trillion yuan (up 3.5%). This growth was fueled by expanded digital infrastructure: 72.88 million km of fiber optic cable, 4.25 million 5G base stations, and over 90% of administrative villages connected to 5G.

2. Growth in Core Tech Sectors and Industrial Applications

In Q1 2025, investment in digital and tech industries surged: information services rose 66.4%, office equipment and computer tech grew 31.6%, and aerospace equipment rose 27.1%. Cross-sector manufacturing also expanded by nearly 9%, signaling a shift toward advanced manufacturing.

3. Innovative Technologies and Tech Independence

Amid global pressures, China seeks technological self-reliance. In semiconductors, government-backed R&D spending rose 50% for core equipment firms, with self-sufficiency targets set at 35% by end-2025. Emerging sectors include chiplets, optical circuits, quantum computing, and high-altitude economy tech (e.g., drones, eVTOL), all seeing rising investment.

4. Market Value and Institutional Innovation

By 2025, the market value of tech firms on HKEX exceeded $1 trillion (~10 trillion HKD). The Hang Seng Tech Index surged 30%. Giants like Tencent, Baidu, and Xiaomi are heavily investing in AI, cloud computing, and IoT, creating a competitive innovation ecosystem.

5. Industrial AI and Robotics as Change Agents

China is actively deploying humanoid robots in industries, supported by $20+ billion in government funding. Startups like AgiBot and MagicLab are leading the way. Embodied AI is expanding into everyday services—e.g., drones and robots for public services—especially in cities like Shenzhen.

6. Global AI Governance and Emerging Tech

At WAIC 2025 in Shanghai, China launched a global AI governance plan promoting international collaboration and strict regulation, reflecting its ambition for a leadership role. The government is rapidly integrating AI into public health and service sectors despite U.S. chip export restrictions.

7. Massive Growth Opportunities via 5G and AI

According to GSMA, mobile and digital technologies could contribute $2 trillion to China’s GDP by 2030, largely driven by 5G and AI expansion.

Quick Summary – Key Strengths and Trends

| Area | Current Status & Outlook |

|---|---|

| Digital Infrastructure | Massive 5G & fiber rollout with near-universal coverage |

| Industrial Investment | Rising in digital services and advanced manufacturing |

| Tech Self-Reliance | Focus on semiconductors and frontier technologies |

| Institutional Innovation | Tech giants investing in AI & IoT |

| Smart Robotics | Widespread deployment in industries and services |

| AI Governance | Ambitious leadership in global regulations |